From the World Bank to pension funds, efforts are under way to regulate land grabs through the creation of codes and standards. The idea is to distinguish those land deals that do meet certain criteria and should be approvingly called "investments" from those that don't and can continue to be stigmatised as land "grabs". Up to now, it was mostly international agencies that were trying to do this. Now, the private sector is engaging in a serious way to set its own rules of the game. Either way, the net result is voluntary self-regulation -- which is ineffective, unreliable and no remedy for the fundamental wrongness of these deals. Rather than help financial and corporate elites to "responsibly invest" in farmland, we need them to stop and divest. only then can the quite different matter of strengthening and supporting small-scale rural producers in their own territories and communities succeed, for the two agendas clash. In this article, GRAIN gives a quick update on what is going on.

The current wave of land grabs affecting many parts of the world is widely recognised as an incontestable reality and a significant threat. Hundreds of deals have been documented in the last few years in many sectors, from timber and mining to palm oil and pork production. Published estimates of how much land is involved range from 80 million hectares to a breathtaking 227 million. And the accounts of dispossession, violence, death and ethnic assault associated with these deals have been steadily growing. Yet, among those in power, the main political discussion under way right now is not about how to stop land grabbing. It is about how to make it work.

The international agencies, like the UN Food and Agriculture Organisation (FAO), the World Bank or the UN Conference on Trade and Development (UNCTAD), are genuinely worried about the negative consequences of what they prefer to call large-scale land acquisitions. But the role they carve out for themselves is to harness this money in the name of old school development dogma -- the belief that foreign direct investment leads to economic growth which trickles down to benefit the majority. Their efforts thus centre around the creation of voluntary rules that governments or companies can use to discipline and guide the land deals.

Not that President Sirleaf of Liberia, Omar al-Bashir of Sudan, Cristina Fernández of Argentina or Viktor Yanukovych of Ukraine are shouting out to the international community to (help them) stop land grabbing. on the contrary, most governments want the deals, they are signing them, and they are often suppressing communities that rise up and resist expulsion or make noise about the poor wages or the loss of grazing lands for their livestock that quickly ensues. only in a few countries are legislators, courts, administrative officials and political parties trying to set some basic limits on farmland acquisitions in the face of escalating interest from foreign investors.1

Meanwhile, investors from the private sector, like pension funds and private equity groups, are marching ahead and organising their own standards for farmland acquisitions. They want to shield themselves from criticism and provide some kind of road map for "responsible" farmland investment practices. Such responsible investment tools, whether codes or principles or guidelines, also have a very plain dollars-and-cents role in protecting investments. They are designed to provide some security that some amount of financial return will be achieved, not unlike an insurance policy. For institutional investors, such as pension funds, which have a fiduciary duty to perform, this can be quite important.

The momentum -- in circles of power -- is thus clearly on the side of accommodating land grabbing and turning it into something more acceptable through rules, regulations, policy frameworks or guidelines, despite the demands for an end to the land grabs emanating from local communities, farmers' movements and indigenous peoples in the affected areas.

What's up at the World Bank?

When the current wave of massive land grabs became a clear trend in 2008-2009, the World Bank jumped into motion and proposed a very ambitious programme to facilitate their acceptance as a legitimate business practice. The initiative proposed a set of seven "principles", meant to demarcate what would be understood and accepted as "responsible" farmland investments, and a new institutional architecture, independent of the Bank, that would benchmark and certify such investments with a "label".2 The seven principles for responsible agricultural investment (RAI) were eventually co-sponsored by FAO, UNCTAD and the International Fund for Agricultutral Development (IFAD). But they were forcefully rejected by civil society -- from small farmers organisations in Japan to women's groups in Senegal -- as legitimising land grabs.3 They were even criticised within official circles as top-down or imposed.4 Soon after, the rest of the Bank's programme was slightly scaled back.

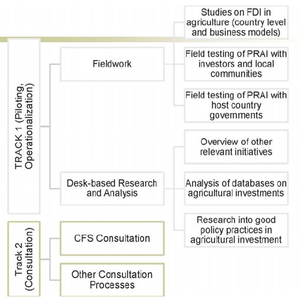

GRAPH 1: finalising PRAI

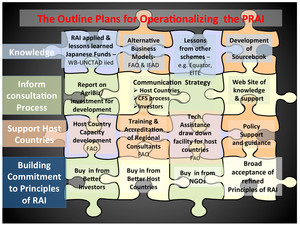

GRAPH 2: operationalising PRAI

According to Graham Dixie, who recently replaced John Lamb as the Bank's agribusiness team leader, the Bank was initially going to "pilot test" the RAI principles through six case studies.5 This would mean implementing the principles on a test basis and learning how they work or don't work, how compliance is achieved, what adjustments are needed, etc. Dixie says they scrapped this approach because it would take too long and there was no certainty that selected projects would push through. Instead, the Bank is now "retrofitting" the RAI principles to existing large scale land investment deals. Retrofitting means examining whether and how existing projects, meet the RAI principles and drawing lessons from there. An initial 40 projects, from large-scale estate-type plantations to outgrower schemes, will be selected, one-third of them from Asia and two-thirds in Africa. Investors and communities involved in the projects will be interviewed in order to retain only 15 cases for deeper examination. (See Graph 1.6) The government of Japan is funding this work and UNCTAD will be helping with some parts of it. The review of the 40 cases will take place from August-September 2012 and the final conclusions from the indepth study of the 15 cases is to be completed by May 2013. How the RAI principles are ultimately meant to play out at an operational level is shown in Graph 2.7

The Bank's RAI initiative may be less ambitious than what was originally planned, but it is still a serious attempt to validate land deals that the Bank would like to see supported. This makes the principles for RAI, or PRAI as they are sometimes called, quite dangerous given the Bank's participation in land grabs. The World Bank Group as a whole -- the Bank itself, the International Finance Corporation and the Multilateral Investment Guarantee Agency (MIGA) -- is directly engaged in numerous agribusiness projects that involve transfers of control over farmland, whether through loans, equity positions, political risk insurance or other.8 The same is true, in other ways, for the Bank's partners in promoting the RAI, i.e. UNCTAD, IFAD and FAO.

Justin Rowlatt of the BBC World Service interviewed US businessman Neil Crowder of Chayton Capital on his 20,000 ha agribusiness venture in Zambia in March 2012. An excerpt:

JR: What if the government falls? This comes back to what I was saying before. Ownership of land is absolutely central in all societies. If you've got a venture capital firm from abroad that owns swathes of your country, you are going to be liable to be targeted if there is an upset, politically, aren't you?

NC: Potentially. I think it varies from country to country.

JR: But how do you offset political risk? Because investors must ask you about that.

NC: We have a very specific approach: we work with the World Bank. The World Bank has underwritten our assets for political risk.

JR: Hold on a second. The World Bank has given you some kind of insurance against the government changing and the attitudes toward you changing?

NC: Correct. We have a relatively unique agreement with the World Bank that we pay a premium for insurance and they guarantee against expropriation.

JR: I'm slightly surprised that the World Bank offers such insurance policies!

NC: No, because what we're doing is very - there is a very big development impact in what we're doing.

JR: Hold on. Coming back to this guarantee that you've been given by the World Bank, this kind of insurance: that means that, in a sense, there is no risk (laughter) attached to your business in Zambia.

NC: There are all kinds of risks with investing. We try to mitigate as many as we can. My own view in Zambia is that we don't need the insurance. We've been very...

JR: But you pay for it!

NC: We do pay for it. And the reason we do that is because our investors are concerned about it.

JR: Okay, well, let me put another scenario to you. Say there is some kind of drought and food becomes scarce in Zambia and your efficient farm is still producing. What happens then? Because surely the government is going to want your food to distribute to the people. What do you do in that sort of situation?

NC: Again, our political risk insurance protects us against civil disturbance or inability to use the assets for any reason and expropriation. So I think we're protected.

JR: Listen, I want some of this insurance! Where can I sign up?

NC: We've been very pleased with the World Bank and their involvement. It's not easy to get.

Source: Out of Africa? BBC World Service, 23 March 2012. Available athttp://farmlandgrab.org/post/view/20224

FAO: levelling off the playing field

The UN Food and Agriculture Organisation has been challenged by the current land grab trend every since it became clear in 2008. Jacques Diouf, the Director General at the time, warned of "neo-colonialism" while staff tried to contain the damage. FAO had to walk a tightrope from the start not just because of the blunt language used to describe what was going on (land grab), but because of the sensitivity of the issue in which key FAO funders, like the government of Saudi Arabia, were implicated. FAO's response so far has been to adopt a "laissez-faire" approach. It joined the World Bank, IFAD and UNCTAD in endorsing RAI and it held a number of consultations and conferences where the matter was analysed and discussed, most often presented as a "development opportunity". Recently, the FAO-hosted Committee on World Food Security (CFS) has taken the issue up, with direct civil society participation.

The CFS, celebrated as a platform where various players -- government, civil society and the private sector -- have a seat at the table to discuss key issues affecting world food security, first took up the land grab problem within the context of the Voluntary Guidelines (VGs) on governance of land tenure.9 The guidelines were adopted in May 2012, after a three-year process of bottom-up consultation. They aim to provide guidance, mostly to governments, on how to improve the development and implementation of land rights and tenure governance systems. They are acclaimed for having the merit of being internationally agreed to (by governments) and of putting emphasis on the rights and needs of "marginalised" people (diplomatic-speak for women, indigenous peoples and the poor).

But they are, after all, only voluntary and some see them as far away from realities on the ground. There are those who point out that it is unrealistic to expect corrupt governments or dysfunctional states to actually implement such a code. Even in a country like Liberia, led by an acclaimed Nobel Peace Prize winner, the President is on record for threatening local communities who do not accept her government's decision to allocate 300,000 ha to Malaysia's Sime Darby for a plam oil plantation.10 However, civil society groups involved in developing the guidelines feel that it is really up to different parties to push for implementation.

The VGs carry one chapter on "investment" and it is almost entirely dedicated to "responsible investments in land". This chapter does not try to stop land grabbing. Instead, it articulates how such deals "should" be pursued to cause the least damage. In only one instance are states invited to "consider promoting a range of production and investment models that do not result in the large-scale transfer of tenure rights to investors" (Article 12.6). This is as anti-landgrabbing as the VGs get and this is a problem, because the guidelines are being used now as a precedent or starting point for further policy work on land.

The CFS is now embarking on another consultation process on "responsible agricultural investment".11 Civil society groups participating in it have demanded that the discussion focus on "rai" with small letters as opposed to RAI in capital letters associated with the World Bank's seven principles. The consultation is expected to be launched by CFS in November 2012 for conclusion at the following meeting of CFS in October 2013. Civil society groups are entering the process by forcefully framing the discussion around investment by small scale farmers and food producers -- not finance capital and corporations, which is what a lot of people think of when they think of investment. While no one can predict the outcome, this approach clearly puts on the table what is really needed by way of investment: to promote food sovereignty rather than further trying to make land grabbing, and the industrial production model that goes with it, "responsible".

Voluntary frameworks and guidelines and codes of conduct, drawn up (or in process of being elaborated) by multilateral agencies and fora:

G8 ▪ G20 ▪ African Union Framework and Guidelines on Land Policy in Africa ▪ AU Declaration on Land Issues and Challenges in Africa ▪ UN Special Rapporteur on the Right to Food Set of Minimum Principles for Land Investments ▪ Committee on Food Security Voluntary Guidelines on the Responsible Governance of Tenure (Chpt 12: Investment) ▪ World Bank, FAO, IFAD and UNCTAD ▪ APEC ▪ Pan-African Parliament

Internal corporate policies and instruments, and support advisory services:

UN PRI ▪ Principles for Responsible Investment in Farmland ▪ African Agriculture Fund ▪ IHRB draft guidelines on a rights-based approach to business land acquisition and use ▪ IFC Performance Standard 5 on Land Acquistion and Involuntary Resettlement ▪ Sustainalytics ▪Interfaith Center on Corporate Resposibility Recommended Guidelines for Responsible Farmland Investment ▪ plus the many investment funds and firms directly involved in land acquisitions which do not place their "responsible investment" policies and instruments in the public domain

Farmland investors gathered at the ritzy Waldorf Astoria hotel in New York City, April 2012

The corporates calling their own shots

The vast majority of the capital flows going into today's largescale farmland transactions are moving through private channels. In the absence of strong public policy interventions to stop or contain it, the private sector is moving ahead to serve its own regulatory needs, without the public oversight.

Voluntary self-regulation is the name of the game for industry, with many instruments, advisory services, support groups and mechanisms being created and put into play. Socially responsible investing is a huge business in and of itself.13 Some estimate that it may account for US$ 3 trillion in terms of assets under management today.14 Whatever the scope, businesses are putting a lot of effort into trying to convince themselves, each other, regulators, traders and the public that their operations do no evil.

At the international level, the business community has come together around two general processes -- the UN Global Compact and the UN Principles for Responsible Investing -- to set standards of good corporate behaviour. Both the Compact and UN PRI are membership bodies and require adherence to certain norms. But they are voluntary and have no means of enforcement. In fact, the Compact had to throw out 2,000 of its members last year when it ran a review of who was applying the good business behaviour standards it advocates and who was not (see box). The members of the Organisation for Economic Cooperation and Development, the wealthiest nations of the planet, also have their own OECD Guidelines for Multinational Enterprises, which are also voluntary and toothless, and strongly promote corporate self-regulation.15

There is no consensus on what constitutes responsible investment, how it can be monitored, how it should be enforced, etc. For some, just following national laws is "responsible investing". Therefore, any figures on the size of portfolios classified as responsible or ethical should be viewed with caution. But a whole industry exists around it now. In the early years, much of the impetus came from US-based groups urging firms to pull out of South Africa, the blood diamond industry and sweatshop-style textile factories. Hence the birth of corporate social responsibility or "CSR". By 2005, the most popular approach for what by then was called socially responsible investing ("SRI" for short) among European investment institutions was screening out companies involved in arms manufacturing. Campaigns by civil society groups led to several countries such as Belgium, Ireland, Italy, Luxembourg and New Zealand prohibiting investment in cluster bomb production, while pension funds in Ireland, New Zealand, Norway, and Sweden divested or banned such investments. Most recently, the Dutch parliament and cabinet moved to prevent Dutch pension firms from investing in companies involved in cluster munitions and this is now Dutch law. Despite this, in March 2012, the German Bundestag found that nine out of ten ethical investment funds in Germany were engaged in firms associated with arms manufacturing, including nuclear arms production! So how trustworthy can these ethical investment measures be?

Similarly, the UN Global Compact was launched in 2000 as a set of principles that businesses should align with to help ensure that their practices and operations in the world respect human rights, labour rights, the environment and the need to stamp out corruption. Last year, the UN announced that it had expelled more than 2,000 firms -- from Allianz in France to Barclay's Bank in Gambia -- that had signed up to but never implemented the deal. That was more than one-quarter of its membership.

With the recent Rio+20 Summit, the business sector's commitment to what is now called "environment, social and governance"-minded investment ("ESG" in corporate speak) has been refashioned to cash in on the massive financial opportunities being created around climate, energy and carbon-market initiatives. Nothing suggests that these commitments will move anywhere beyond internal and voluntary standards.

In the area of farmland deals, an array of private sector tools have been created. For example:

- The International Finance Corporation has its own "performance standards" with regard to land acquisitions which shape its financial participation in, and support to, land deals. These standards were revised in January 2012.

- In September 2011, almost a dozen large institutional investors, mainly pension funds, got together under the auspices of the UN PRI to construct and promote a set of Principles for Responsible Investment in Farmland. This initiative sent an important message. It showed on the one hand that the private sector will not wait for governments to consult and organise consensual frameworks for largescale land deals. More importantly it showed that the private sector does not need governments to come up with lofty frameworks because the companies are clearly capable of organising and, in this case, regulating themselves. one may not agree with this approach, but the companies are indeed setting their own standards for what constitutes responsible investment in this area. In fact, TIAA-CREF, one of the leaders of global farmland investing within the pension fund industry, will be issuing a first "sustainability report" for its own farmland assets later in 2012. This means a self-evaluation or internal report card, for public relations purposes, on how it has been meeting its own SRI performance standards.

- A range of advisory groups and consultancy firms are eyeing corporate needs and drawing up instruments to shape global investment in farmland. The Institute for Human Rights and Business is one such outfit which is deeply involved in surveys and studies to promote responsible investment in farmland. It determined that land (and water) grabbing would be one of the top ten business and human rights issues in 2012 and embarked on a long process to consult stakeholders and draw up a set of of practices -- beyond principles -- for farmland investing by the private sector. This process is expected to reach completion later in the year. Clearly, the Institute has no means of enforcing any standards, but it does define and promote them.16

Box 2 (above) provides direct links to these and similar initiatives.

The voluntary nature of private guidelines on land investment also means that companies may treat such standards as competitive business information. In some cases, companies involved in managing land deals will not disclose their SRI standards or codes of conduct for largescale land acquisitions to the public, only to their own investors. This is the case of Phatisa, a private equity firm registered in Mauritius but operating out of South Africa that manages the African Agriculture Fund on behalf of the Agence Française de Développement, the African Development Bank, Spain's Agency for International Development Cooperation and others.19Ironically, most "sustainable farmland investment" principles are expected to put transparency at the top of their list, especially transparency towards communities affected by the deals. How can an investor practice transparency if its standards are not transparent?

The whole trend of self-regulation among firms involved in land grabbing is not simply a marketing tool. It is a lucrative business in and of itself. SRI is supposed to add value to investments because it establishes a promise of good behaviour meant to generate broader results than just a bottom line. A lot of resources go into creating and deploying such standards. European cities even compete to provide an attractive domicile for SRI funds because, as a US$30 trillion and growing global business, it can clearly provide local revenue.20 But who really benefits from it?

The Swiss firm Addax Energy has a hugely controversial project to produce sugar cane on 10 000 ha of land it acquired under leasehold in Sierra Leone. The idea is to convert the sugar to ethanol and export it to Europe for use as a biofuel, and production is supposed to get going this year. Addax successfully convinced several European government agencies such as SwedFund and FMO (Entrepreneurial Development Bank), the for-profit development banks of Sweden and the Netherlands respectively, to become financial partners in the project. The European Investment Bank, on the other hand, declined to even consider the invitation. Why? Because the EIB was concerned that the project might not satisfy their enviroment-sustainability-governance (ESG) criteria. How is it that the bank of the European Union works with investment standards that are different from its own members, such as Sweden or the Netherlands? Whose standards are we supposed to trust?

Food for thought

What to do about land grabbing has driven public officials and business leaders into a convenient cul de sac. on the one hand, you have some governments and international agencies trying to draw up globally agreed upon standards for land investments that will be voluntary. on the other hand, you have the corporate sector drawing up its own standards for land investments that are also voluntary, but seem to serve the internal needs of the corporations. What good might come of this bifurcated approach to disciplining land grabs? Most likely nothing, just the status quo. Which is presumably the objective of those involved.

There is an inherent temporal injustice as well. Many of these land deals are concluded for a very long period of time (30 to 99 years), changing the fate of up to three generations of community members yet to come. Any transaction committing large areas of rural land to someone else's agenda for 30, 50 or 99 years is taking that land away from a lot of other possible uses and people. They are, for all intents and purposes, land grabs.

Moreover, while the private sector tries to distinguish above-board deals (which they would like to see understood as bona fide "investments") from less respectable ones (which can continue to carry the stigma of "land grab"), many of these land deals are not investments and don't deserve the label of "investment" no matter how above board or responsible or bona fide. Quite often the deals are speculative; the lands are not developed or put into production but simply flipped after a number of years.22 Other deals are for rent-seeking or rent-capturing purposes.23 The objective in these cases is to extract financial rent, not to develop the productive capacities of the land and build wealth in the community, which often imply a lot of additional costs. If the business model is to maximise profits, then it follows that costs -- including wages, land or water fees, etc. -- will be pushed down as far as possible. This is clearly not investment, not in any socially positive sense.

Accounting for the situation in Indonesia, John McCarthy of Australia National University describes what is going on this way: "In many cases, regardless of the legal provisions, land is acquired without the intention of using it for the purposes outlined in the development license. Many are ‘virtual acquisitions’, which allow investors to appropriate subsidies, obtain bank loans using land permits as collateral, extract timber, or speculate on future increases in land values without developing the land. For instance, state agencies have granted oil palm plantation licenses on over 26 million hectares of land. However, Indonesia’s 33 large oil palm corporations only manage to plant around 300,000-400,000 of new oil palm each year."24

The more fundamental problem with efforts to come up with rules for responsible investment in farmland is that the rules are always about making the project work for the investor. Local communities, soils, watersheds, local labour markets and even the domestic food security situation in the host country are treated as risk factors that need to be mitigated. The objective is to manage costs, including those connected to reputational risks, to ensure an acceptable return. The rules for responsible farmland investment are thus for the investor, for whom taking care of the fallout for local people becomes another cost of doing business -- and one that companies can make profits from to boot.

The credibility of "socially responsible investing" in global farmland is extremely shaky at best. Those who play by it seem to live in their own self-referential world, and can point to no real impact. This is no surprise. Other sectors where this has been tried out -- sustainable cotton, sustainable soy, responsible palm oil, timber, banking and whatnot -- have a profoundly blotted track record.25

Slavery does not get regulated. It gets outlawed. In the same manner, any serious approach to fighting hunger and poverty requires securing people's own control over their lands and territories, not guidelines and rules on how corporations and foreign investors can somehow do a good job of it themselves. What we need is not responsible farmland investment, but divestment. By this we mean that rather than trying to make this new trend of financialising farmland work, these deals need to be stopped and undone, with the lands restituted to the communities that lived from them. And instead of promoting the growth of industrial agriculture, we need to strengthen family- and community-based food sovereignty approaches, across the world. Initiatives are being taken in these directions, aiming to choke capital flows into firms with a history of land grabbing or into funds specifically set up to peddle rights to farmland, bolstered by advocacy and political pressure to support small-scale family-based farming systems and local markets. While it is a huge and uphill battle, it's clear that we need to stop the financing of land grabs, not make it responsible.

▪ FAO's page on RAI: http://www.fao.org/economic/est/issues/investments/en/

▪ UNCTAD's page on RAI: http://unctad.org/en/templates/page.aspx?intItemID=6123&lang=1

▪ CSM's page on rai: http://www.csm4cfs.org/policy_working_groups-6/agricultural_investment-7/

Acronyms

APEC - Asia Pacific Economic Cooperation

CFS - Committee on World Food Security

CSM - Civil Society Mechanism (CFS)

CSR - corporate social responsibility

ESG - environmental, social and governance issues

EU - European Union

FAO - UN Food and Agriculture Organisation

FMO - Entrepreneurial Development Bank (Netherlands)

G20 - Group of 20

G8 - Group of 8

GM(O) - genetically modified organism

IFAD - International Fund for Agricultural Development (UN)

IFC - International Finance Corporation (World Bank)

LIBOR - London Inter Bank Offered Rate

MIGA - Multilateral Investment Guarantee Agency (World Bank)

OECD - Organisation for Economic Cooperation and Development

PRI - Principles for Responsible Investing (UN)

rai - responsible agricultural investment (as discussed by CFS)

RAI - Responsible Agricultural Investment (in upper case, refers to 7 principles sponsored by World Bank, FAO, IFAD and UNCTAD)

ROPPA - West African Network of Peasant Organisations

SRI - socially responsible investing

TIAA-CREF - Teachers Insurance and Annuity Association - College Retirement Equities Fund (US)

UNCTAD - UN Conference on Trade and Development

VG(s) - voluntary guidelines on land tenure (CFS)

1 The chief examples are: Argentina, Brazil, Colombia and Uruguay in Latin America; Australia and New Zealand in Asia; and the Democratic Republic of Congo in Africa. See some discussion in UNCTAD, "World Investment Report 2012", Geneva, July 2012, pp 79-80,http://www.unctad-docs.org/UNCTAD-WIR2012-Full-en.pdf

2 This initial vision of the Bank is laid out in John Lamb's presentation to the East Asia and Pacific Regional Agribusiness Trade and Investment Conference organised by the World Bank together with the International Finance Corporation in July 2009:http://siteresources.worldbank.org/INTEAPREGTOPRURDEV/Resources/JohnLamb2.pdf. As to the certificate or label, it's worth noting that French banks and institutions have also pushed for a label approach to distinguish land investments from land grabs. See the report "Sales of agricultural assets to foreign investors in developing countries", Strategic Analysis Centre, Office of the Prime Minister, Paris, 29 July 2010.http://www.strategie.gouv.fr/en/content/report-sales-agricultural-assets-foreign-investors-developing-countries

3 The principles can be viewed here: http://unctad.org/en/Pages/DIAE/G-20/PRAI.aspx

4 As World Bank staff put it in their long-awaited book on land grabbing, "Observers noted that a broad consultation about these principles has yet to happen." Klaus Deininger and Derek Byerlee, et al, "Rising global interest in farmland", World Bank, Washington DC, 2011, p. 3. http://siteresources.worldbank.org/DEC/Resources/Rising-Global-Interest-in-Farmland.pdf

5 The details in the paragraph come mainly from personal communications with Grahame Dixie on 25 February 2012, confirmed by further communications with Hafiz Mirza on 5 June 2012 and members of the Civil Society Mechanism at the CFS in May and June 2012.

6 Graph taken from Brian Baldwin (IFAD), "Principles for Responsible Agricultural Investment that Respects Rights, Livelihoods and Resources (PRAI)", power point presentation on behalf of PRAI Inter-Agency Working Group (IAWG-UNCTAD, the World Bank, IFAD, FAO), CFS workshop, Rome, 2 July 2012,http://www.csm4cfs.org/files/SottoPagine/61/rai_wshop2july_compilation_written_inputs.pdf

7 Grahame Dixie, World Bank, "Responsible investments in agriculture: what do we know, what are we learning and what to do about it," presentation to Global Ag Investing Asia, Singapore, 5-7 December 2011. http://www.cvent.com/events/global-aginvesting-asia-2011/custom-21-489ef1acfc6a4521b447a6756eb47235.aspx

8 A range of organisations and journalists have been documenting the involvement of the Bank in land grab deals. In 2012, Friends of the Earth International issued a major report on what has been happening in Uganda: http://www.foei.org/en/media/archive/2012/new-report-uncovers-world-bank-funded-land-grab-in-uganda. A classic case of MIGA's involvement is Neil Crowder's project in Zambia, captured by the BBC World Service here:http://farmlandgrab.org/post/view/20224. In 2011, the Oakland Institute produced various reports on the issue, summarised by the Bretton Woods Project here:http://www.brettonwoodsproject.org/art-568890. The BWP produced a more recent summary in 2012, available here: http://www.brettonwoodsproject.org/art-570786. The website farmlandgrab.org, run by GRAIN, tracks all such materials in one dedicated section:http://farmlandgrab.org/cat/show/88.

9 Available online at http://www.fao.org/nr/tenure/voluntary-guidelines/en/.

10 See Silas Kpanan'ayoung Siakor and Rachael S. Knight, "A Nobel Laureate’s problem at home", New York Times, 20 January 2012. http://www.nytimes.com/2012/01/21/opinion/in-liberia-a-nobel-laureates-problem.html

11 Documents recording this process are available at the CFS Civil Society Mechanism website: http://www.csm4cfs.org/policy_working_groups-6/agricultural_investment-7/

12 A basic inventory was prepared by UNCTAD for a 2 July 2012 workshop at the FAO in Rome: http://www.csm4cfs.org/policy_working_groups-6/agricultural_investment-7/phase_1_july_2_rai_workshop-60/

13 The terminology can be bewildering for outsiders. At first, there was ethically targeted investing (ETI). This gave way to socially responsible investing (SRI). Today, the focus is on environment, sustainability and corporate governance (ESG) issues. In all cases, we are talking about passing a filter over investments in terms of their impact on the environment, respect for labour law and human rights, etc. Sometimes the screening is negative, to avoid something. Sometimes it's positive, such as when companies engage in social projects to help communities in areas affected by the investment. In some cases, the criteria apply only to the investment, not the investor. And so on.

14 TIAA-CREF, "2012 Socially Responsible Investing Report", July 2012. http://www.tiaa-cref.org/public/sri2012/index.html

15 The 2011 update of the guidelines is available athttp://www.oecd.org/daf/internationalinvestment/guidelinesformultinationalenterprises/oecdguidelinesformultinationalenterprises.htm.

16 Kelly Davina Scott, IHRB, personal communication, 3 May 2012.

17 Robin Bonsey, of Amundi's SRI team, personal communication, 3 July 2012. Amundi is presently studying the land grab issue in order to devise SRI grades related to farmland acquisitions, both direct and indirect, for its clients.

18 The LIBOR rate at which banks lend money to each other, which recently became headline news since Barclay's was found manipulating it, is also a voluntary construct. It is drawn up on a daily basis from information volunteered by a consortium of private banks. Its unreliability not only ended up costing many people a lot of money, but it clearly fostered criminal behaviour.

19 Izelle le Roux-Owen, Phatisa, personal communication, 14 April 2012.

20 Daniel Brooksbank, "Analysis: the race to become Europe’s responsible investment fund domicile," Responsible Investor, 25 June 2012. http://www.responsible-investor.com/home/article/analysis_responsible_investment_fund_domicile/P0/

21 Katie Beith, UN PRI Secretariat, personal communication with GRAIN, 3 July 2012.

22 See "Land grabbing by pension funds and other financial institutions must be stopped", civil society statement against the finance of land grabs, Brussels, 26 June 2012, Note 1.http://www.foeeurope.org/sites/default/files/press_releases/joint_statement_on_the_finance_of_land_grabs_june_2012_en_1.pdf

23 See Michel Merlet, "Investment: Magic word or trap?", aGter, August 2012,http://www.agter.asso.fr/article852_en.html, and H. Cochet and M. Merlet, "Land grabbing and the share of the value added in agricultural processes. A new look at the ditribution of land revenues", paper presented at the international conference on global land grabbing, University of Sussex, 6-8 April 2011, http://www.agter.asso.fr/article604_en.html.

24 "Energy, food and climate crises: are they driving an Indonesian ‘land grab’?", East Asia Forum, 17 July, 2012 http://www.eastasiaforum.org/2012/07/17/energy-food-and-climate-crises-are-they-driving-an-indonesian-land-grab/

25 See "Audits reveal no benefits from RTRS certification", CEO, Friends of the Earth and GM Freeze, 22 May 2012. http://www.corporateeurope.org/pressreleases/2012/audits-reveal-no-benefits-rtrs-certification

'庫間 > 해외자료' 카테고리의 다른 글

| 안데스의 전통지식을 재평가하다 (0) | 2012.09.16 |

|---|---|

| 가뭄 이후 40년 만에 대두 재고량이 최저 (0) | 2012.09.12 |

| 수요 증가와 도시화가 세계 식량체계의 과제 (0) | 2012.09.07 |

| 방글라데시 둠벙에서의 양어 (0) | 2012.09.04 |

| 농약과 스리랑카 농업지대의 신장 질병과의 상관성 (0) | 2012.08.27 |